DIAS™: Dynamic Investment Allocation Strategies

Diversified Investment Management Solutions designed to meet client goals by actively adapting to economic and market conditions.

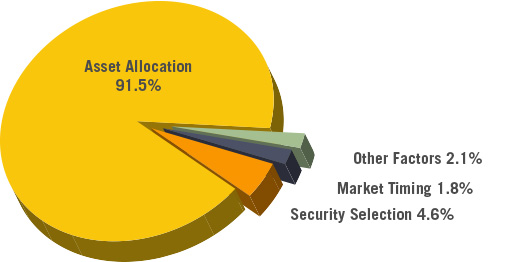

DIAS™ tactical investment strategies are based on the principle that, for consistent investment performance, actively allocating capital to the most attractive, risk adjusted asset classes—while avoiding the least attractive areas—may be more effective than attempting to select the historically “best performing” stock or bond manager or mutual fund. In our opinion, the most important part of investment management is deciding how much capital to allocate to each asset class and, often more importantly, which asset classes to avoid.

Our investment philosophy is a truly diversified approach that adapts to market and economic changes and has the flexibility to dynamically invest across a wide range of asset classes. DIAS™ aims to “tilt the odds” in the favor of the investors by gradual and progressive asset allocation changes together with disciplined risk management.

What Drives Portfolio Performance?

A Smoother Investment Ride

A smoother investment ride may be achieved by targeting upside participation during times of capital appreciation while limiting downside losses when markets offer little opportunity for gain.

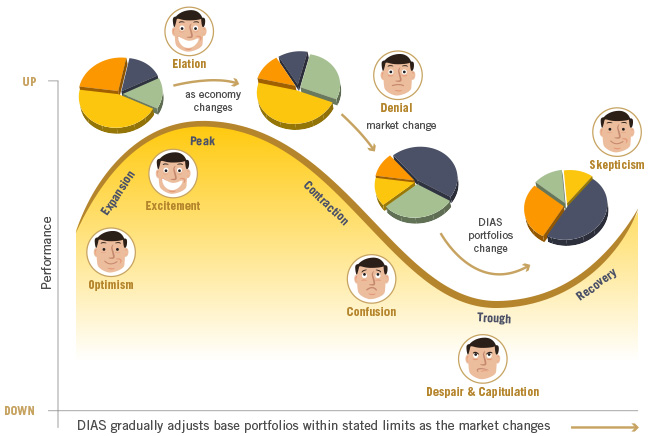

Many “liquid securities markets” tend to experience ups and downs in repeatable cycles, as shown in the hypothetical diagram below. Often these cycles are driven by emotional factors, such as investor exuberance or capitulation.

An important component of the DIAS™ investment methodology is the exploitation of these “human factors.” When prices reach new highs without clear support from our research data, we have a tendency to sell those holdings that appear to be the most overvalued, thereby locking-in profits. Conversely, when panic selling appears to be unjustified by hard data, expect our portfolio managers to be searching for temporarily discounted assets to add to our portfolios.

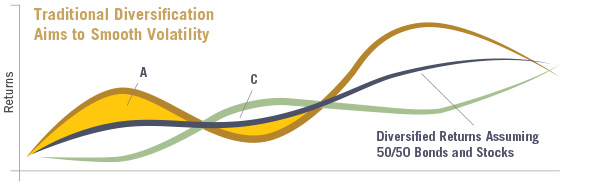

Dynamic diversification seeks to actively move between the market cycles of different, noncorrelated,

asset classes in an attempt to avoid those regions whose cycle is causing the majority of prices to fall, while participating in sectors where the cycle is in a positive phase. The goal is to provide consistent, lower volatility returns by combining the returns of various asset class cycles moving in different directions, as shown in the accompanying hypothetical diagram.

Although DIAS™ generally involves diversification across a greater number of asset classes, sectors and geographical regions than those found within traditional single asset class portfolios, for example large cap growth or fixed income strategies, the accompanying diagram illustrates how smoother returns may be generated in the simple case of just two asset diversified classes. Most investment philosophies concur that risk may be reduced by combining different asset classes, each with

their own specific correlation characteristics. In other words, don’t put all your eggs in one basket. Comprehensive diversification cannot guarantee to eliminate loss of capital; however, it can reduce the probability of excessive declines in portfolio valuation.

In this way, smoother, less volatile investment returns may be possible for those investors who require more consistency.

Capital Preservation

For our conservative investors, we were able

to generate full-year positive returns1 in both 2008 (Credit Crisis) and 2002 (end of Dotcom bubble). These two years and periodic corrections in a number of markets, validate our focus on Capital Preservation. Risk management is at the core of our management philosophy.

The aim of asset allocation is not to chase excessive returns in good markets, only to then suffer severe declines in bad markets. We seek to balance risk against the potential for reward.

DIAS™ is a disciplined methodology which emphasizes investment quality when approving securities for inclusion in our portfolios. Once we identify a prospective investment, we research the underlying credit quality, balance sheet stability and trading liquidity as our primary measures of investment quality.

1 There can be no guarantee that DIAS™ portfolios will generate a positive return. During 2008, the Conservative Income portfolio experienced intra-year

losses to investor capital.

An Income Bias

We often compare our income portfolios to owning a diversified portfolio of high quality rental properties, occupied by stable, profitable tenants. Although DIAS portfolios rarely allocate significant

capital to property, such a hypothetical portfolio would ideally produce a consistent income stream from which you can continually draw. The price of the properties would be secondary to the consistency of income providing the investor with a level of comfort and sustainability throughout periods of price volatility. In this theoretical example, falling property prices may be an opportunity to increase the

portfolio’s income.

We believe, now more than ever before, that during periods where asset appreciation is difficult to find, income could be the primary solution to fund our clients’ financial and lifestyle needs.

Cost Efficiency

The internal costs associated with running a portfolio can dramatically reduce returns, especially in times of flat or falling markets. Trading costs, internal fund expenses and taxation are all considered when managing DIAS™ portfolios. Unlike many Mutual Funds, DIAS™ portfolios are held in separate managed accounts which do not participate in marketing, platform and other fees.Actual investment costs and taxation will depend on the specific circumstances of each individual investor. A Global Financial Advisor is available to discuss your personal situation.2

2 For detailed tax advice, please consult a qualified tax professional or Certified Public Accountant (CPA).

Institutional Levels of Diversification

Large institutional funds, college endowments and public retirement funds commonly invest across a wide range of asset classes, regions and types of security. They seek participation in those areas which are undervalued or potentially approaching a rise in value. Their goal is consistency in achieving target returns.

The DIAS™ management approach looks to participate across similar levels of

diversification as a means to generate income or capital gain within a wide range of economic environments.

Retail investment options offered by large brokerage organizations tend to result in a limited investment selection for clients which are weighted heavily towards stocks and bonds.

Investment Choice Matched to Your Needs

DIAS™ portfolios can be mixed and matched to create a solution designed to meet your specific income, capital appreciation and volatility goals. Our aim is to manage your lifetime savings with both your financial and risk-comfort requirements in mind.

If the returns of your current investment manager often appear to mirror the ups and downs of the general stock market, or you are constantly being asked to “wait for things to come back;” now might be the right time to consider talking to a Global Financial Advisor about the DIAS™ investment approach.